Table of Contents

- What is corporate tax in the UAE and who must register?

- Is corporate tax registration mandatory in UAE?

- Required documents for corporate tax registration in UAE

- How to register for corporate tax in the UAE: Step-by-step process

- Timeline & fees for corporate tax registration

- Tax filing deadline

- Registration fees

- What happens after registration?

- Common mistakes during corporate tax registration (and how to avoid them)

- FAQ: UAE corporate tax registration

- UAE Corporate Tax Compliance Checklist

- Final thoughts: Don’t delay corporate tax registration in the UAE

- Take the first step toward corporate tax management in the UAE!

What is corporate tax in the UAE and who must register?

Corporate tax in the UAE is a federal tax imposed on the net profit of legal entities and individuals conducting business activities within the country. The standard corporate tax rate is 9%, but it applies only to profits that exceed the legally defined threshold.

Even if a business earns below the threshold and owes no tax, registration is still mandatory. All taxable persons — including LLCs, free zone companies, freelancers, offshore companies, and branches of foreign companies — must register with the Federal Tax Authority (FTA) and submit annual tax returns, regardless of whether any tax is payable.

Who is subject to corporate tax? (individuals vs legal entities)

The following entities and individuals are subject to corporate tax in the UAE:

- All companies (mainland and free zone) with income exceeding 375,000 AED

- Branches of foreign companies operating in the UAE

- Natural persons conducting licensed business activities with income above 1 million AED (e.g., freelancers, sole entrepreneurs)

- Certain legal entities such as funds and trusts

Entities exempt from corporate tax include:

- Government and government-controlled entities (subject to conditions)

- Companies engaged in extraction of natural resources

- Public benefit organizations and approved foundations

- Investment funds meeting specific criteria

- Companies with income below AED 375,000 (note: registration is still mandatory)

Free Zone Companies: Are they exempt?

Free zone companies benefit from a 0% corporate tax rate only on qualifying income. The Federal Tax Authority (FTA) requires clear evidence and separate accounting for qualifying versus non-qualifying income. Any income not meeting qualifying criteria is subject to the standard 9% corporate tax rate.

Simply put, free zone companies must carefully track income sources to maintain tax benefits and comply with regulations.

What is taxable income?

Corporate tax in the UAE applies to taxable income, which is defined as the net profit or loss adjusted according to the UAE tax laws. Taxable income includes all revenue from commercial activities minus allowed expenses stipulated by law. Additionally, it may account for carried forward losses and applicable tax incentives.

Is corporate tax registration mandatory in UAE?

Yes — corporate tax registration is mandatory for all businesses operating in the UAE and earning profit from their activities.

New companies must register with the Federal Tax Authority (FTA) within 3 months of their establishment. The corporate tax law came into effect in June 2023, and for most companies whose financial year ended on 31 December 2024, the first tax return must be filed by September 2026.

Going forward, all businesses must file their corporate tax return and pay any tax due within 9 months after the end of their financial or tax year.

Real-world examples when registration is mandatory

- mainland companies

- free zone companies

- sole establishments and freelancers

- offshore companies

- branches of foreign legal entities

In summary, anyone conducting commercial activities in the UAE and generating profit must register for corporate tax. Registration is compulsory even if tax payment is not immediately due based on income thresholds.

Voluntary vs mandatory registration: What's the difference?

According to Federal Decree-Law No. 47 of 2022 and FTA regulations, taxpayers in the UAE can register for corporate tax under two scenarios:

1. Mandatory registration

- Any taxable person (legal entity or individual) whose taxable income exceeds AED 375,000 annually, or who is otherwise required under the law.

2. Voluntary registration

- Entities or individuals eligible to register, even if they don't meet the AED 375,000 income threshold, but intend to register early (e.g., a free zone entity wanting 0% rate).

Required documents for corporate tax registration in UAE

Before starting your corporate tax registration on the EmaraTax portal, make sure you have all necessary documents prepared.

- Trade license/commercial registration

- Memorandum of Association/Articles of Association

- Authorized signatory details and Emirates ID

- Passport copies of shareholders/owners

- Address details and proof of business location

How to register for corporate tax in the UAE: Step-by-step process

Before you begin, gather all necessary company documents and owner details on a computer for easy reference.

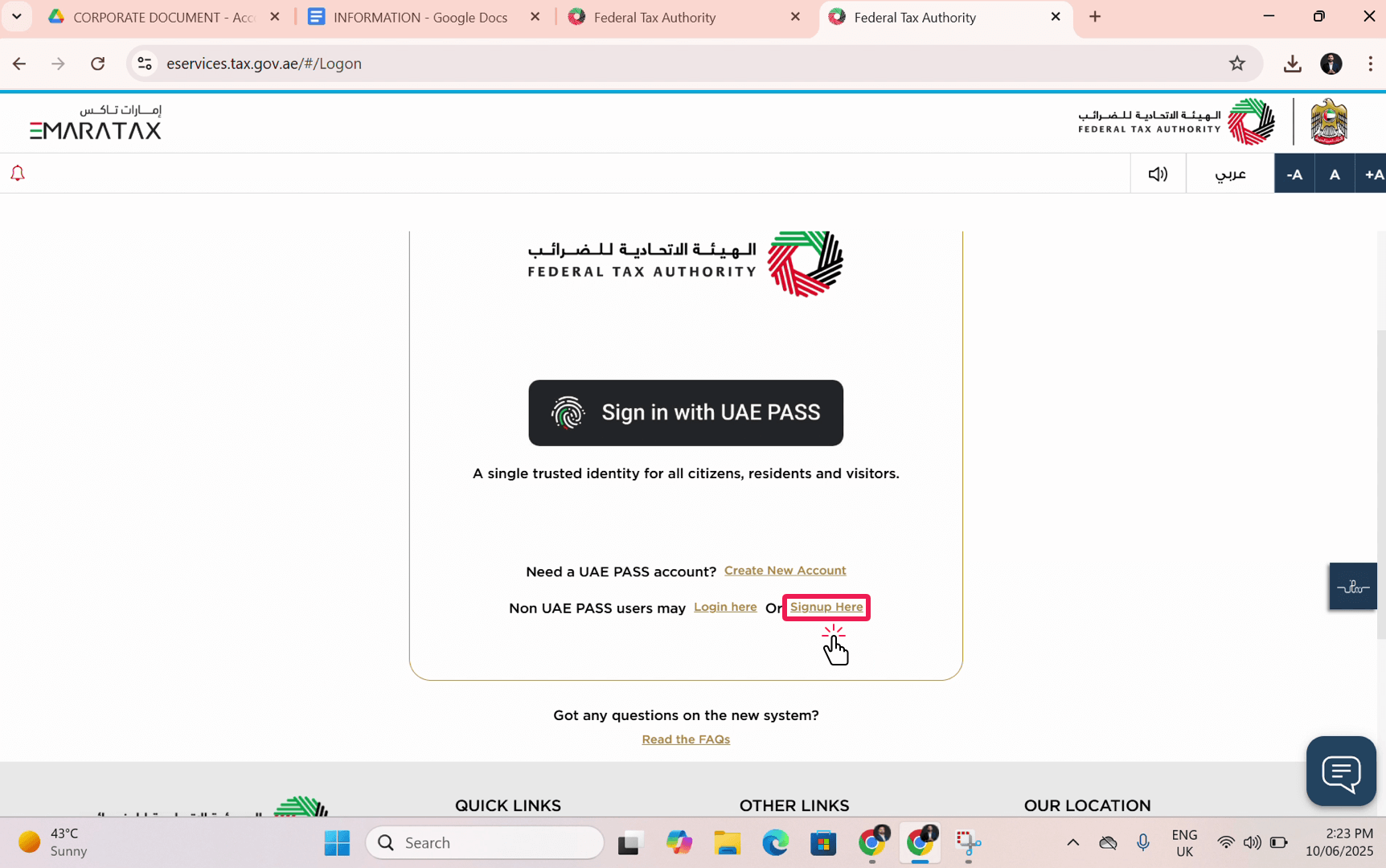

Step 1: Access the FTA login page

- Search for FTA login on Google

- Click on the first link that appears in the search results. This will lead you to the EmaraTax portal - https://tax.gov.ae/en/

Step 2: Sign up for a new account

On the EmaraTax portal page, scroll down and click on Sign up here to create a new FTA account.

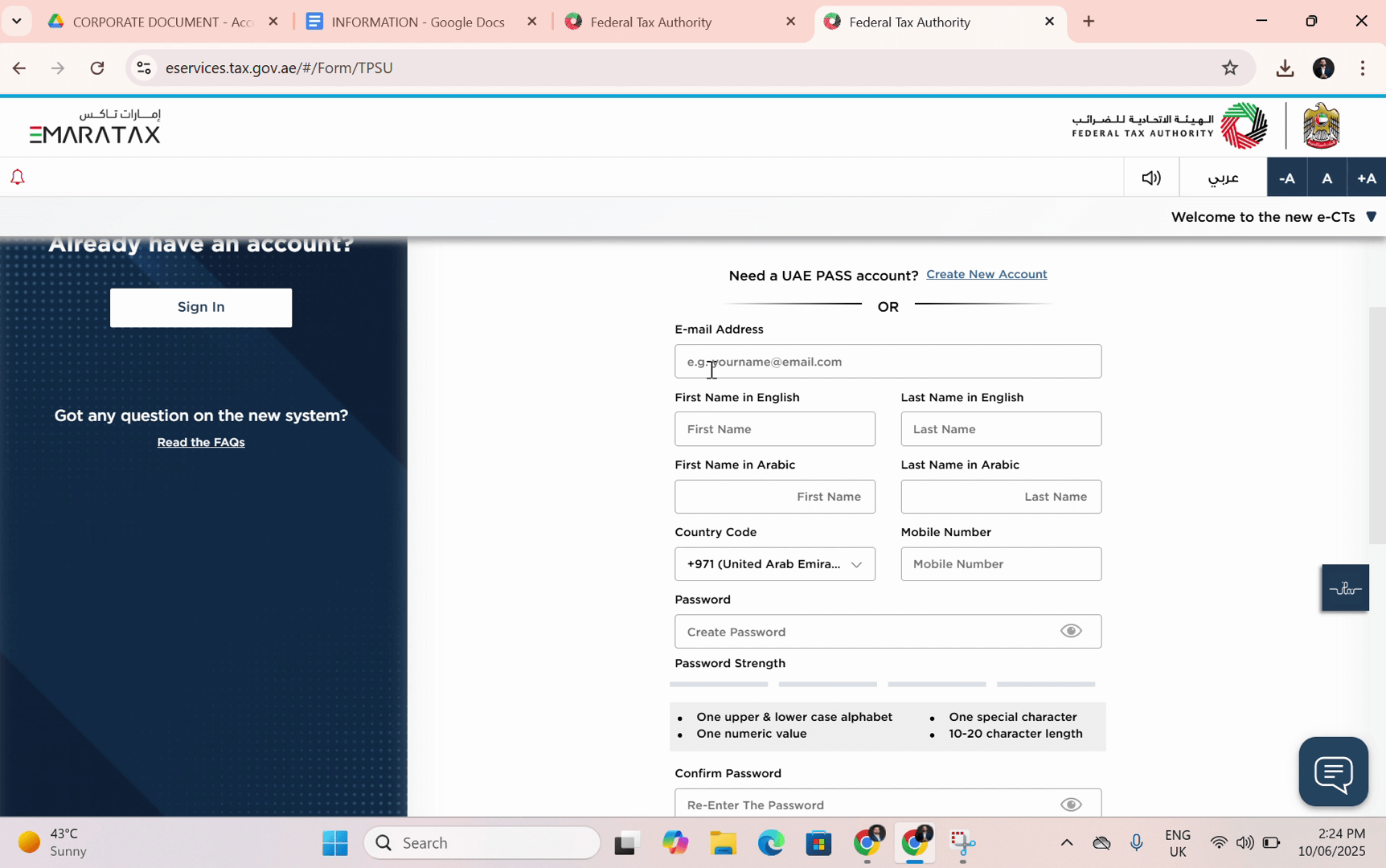

Step 3: Enter owner information

1. Fill in the required information about the owner in the appearing form:

- Email address: Enter the owner's active email address.

- Owner name (English)

- Owner name (Arabic). It's recommended to use the Arabic version found on the Emirates ID (EID).

- Phone number

Step 4: Create and confirm your password

1. Create a strong password that is between 10 and 20 characters long. You can consider using your company name as part of the password.

Step 5: Enter security code and review information

1. Enter the security code displayed on the page.

2. Double-check all entered information carefully, including:

- Email ID

- Names (English and Arabic)

- Password

- Country phone number

Step 6: Enter OTP

1. Once you have verified all the information, click on Continue.

2. You will receive a One-Time Password (OTP) on the registered email address you provided.

3. Enter this OTP into the designated field on the EmaraTax portal to complete the registration process.

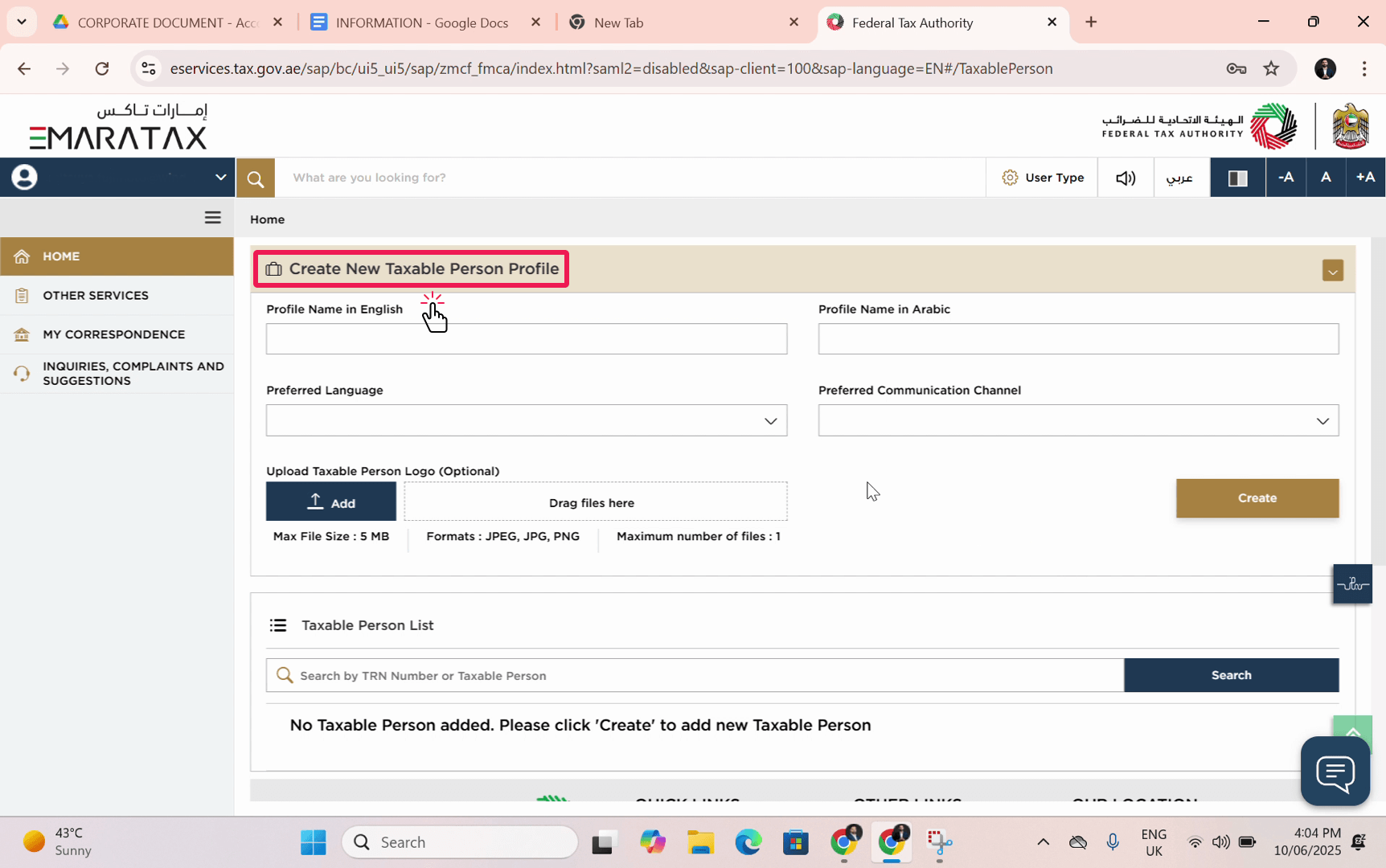

Step 7: Create a Taxable Person

1. Select Taxable Person and click Proceed

2. Fill in your company information:

- Enter your company name in English

- Enter your company name in Arabic

- Select your preferred language and communication channel

Click Create. A new Taxable Person will now be successfully created

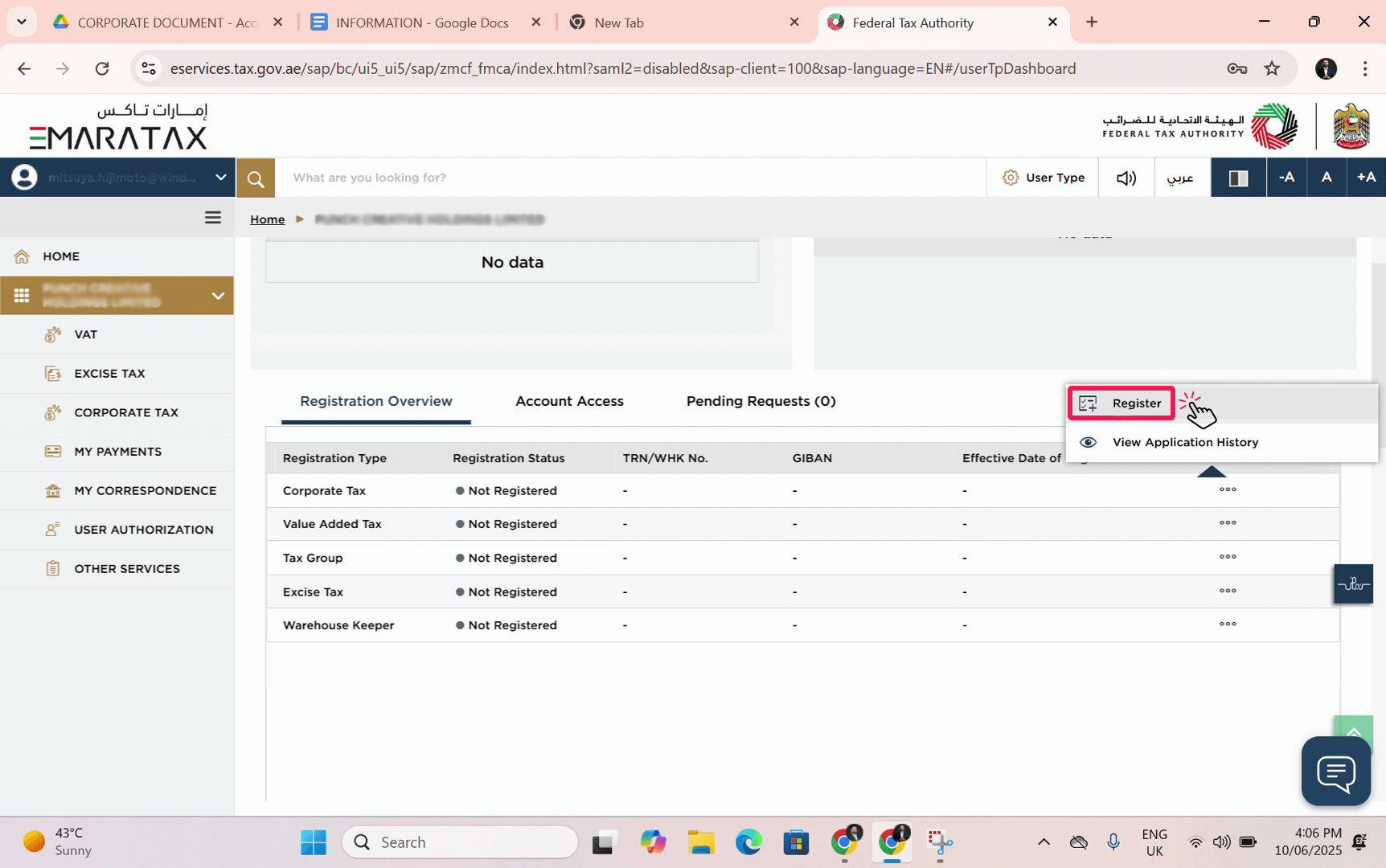

Step 8: Fill in the information about the Taxable Person

1. Click View under your Taxable Person to open your company profile

2. Locate Corporate Tax, click the three-dot Action button, and select Register

3. Read the requirements and, if you agree, check the confirmation box

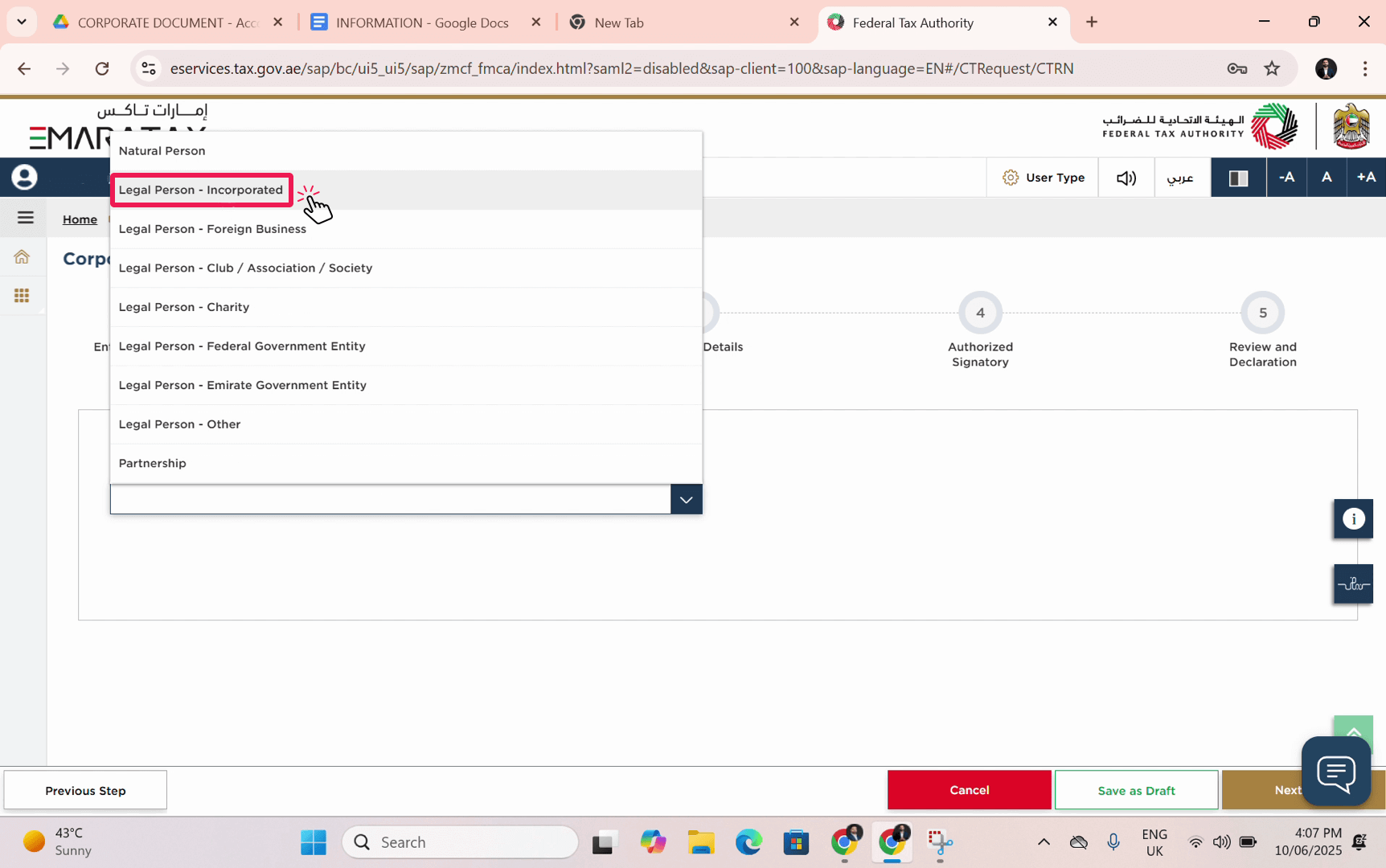

4. Select Entity Type: Legal Person Incorporated (applicable to LLCs, Free Zone Companies, and other entities with separate legal personality. Not typically applicable to sole proprietorships unless separately incorporated as a legal entity.)

Select Subtype: UAE Private Company (including Establishment)

Enter the Date of Incorporation (found on your Certificate of Incorporation)

Indicate whether your entity is a Qualifying Public Benefit Entity

Upload your Certificate of Incorporation

Enter your Tax Period and click Next

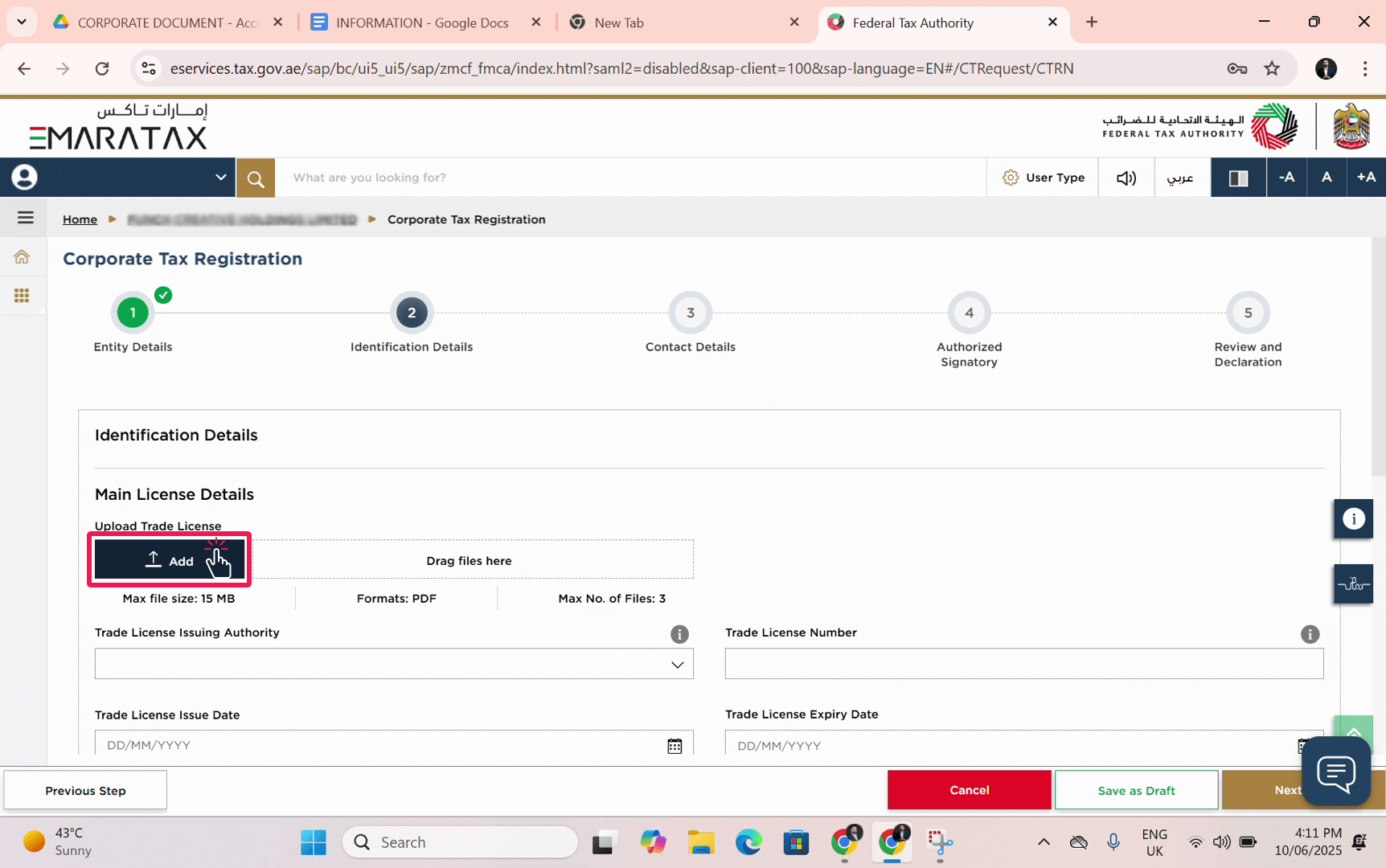

Step 9: License information

1. Upload your Business License

2. Enter license details: issuing authority, license number, issue date, expiry date, and legal name (as per your company name)

3. Select the Business Activity (as per your Memorandum of Association). If you have more than one activity, click Add to include additional ones

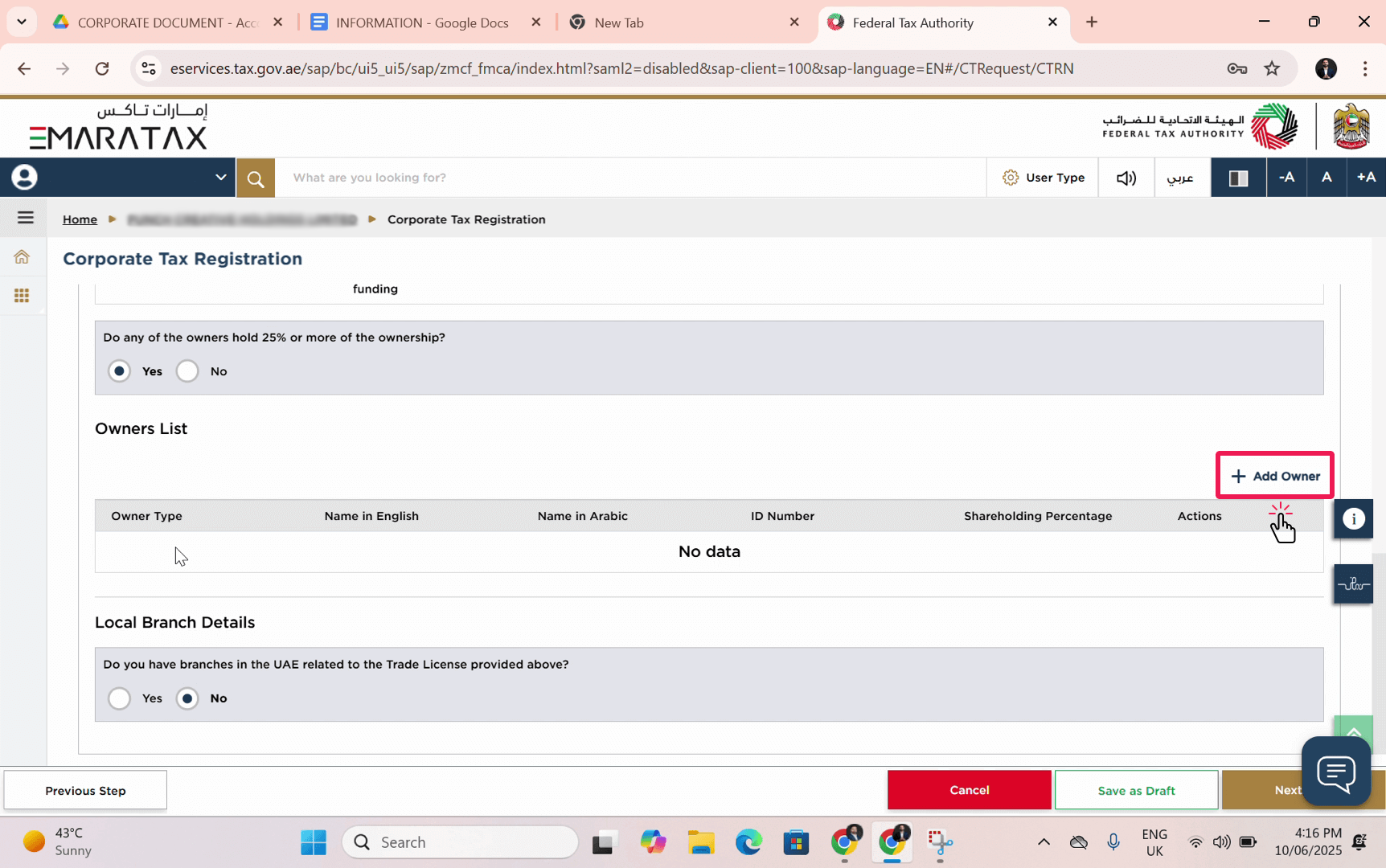

4. Add owners, if there are owners with more than 25% of ownership

5. Select Add owner. Fill in the owner’s details.

6. Proceed to the next step.

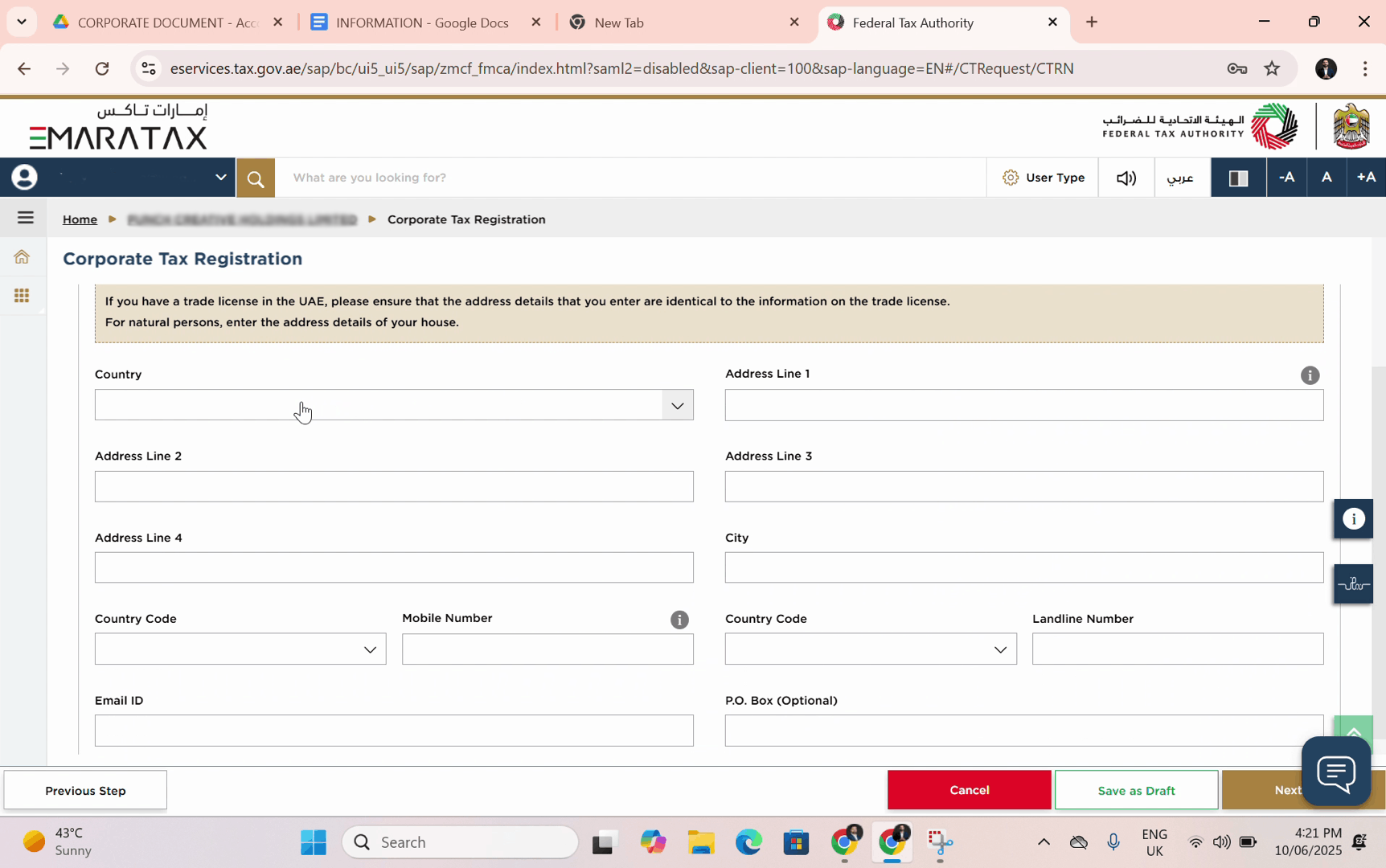

Step 10: Contact Details

1. Fill in your company’s contact details: address, email, and phone number

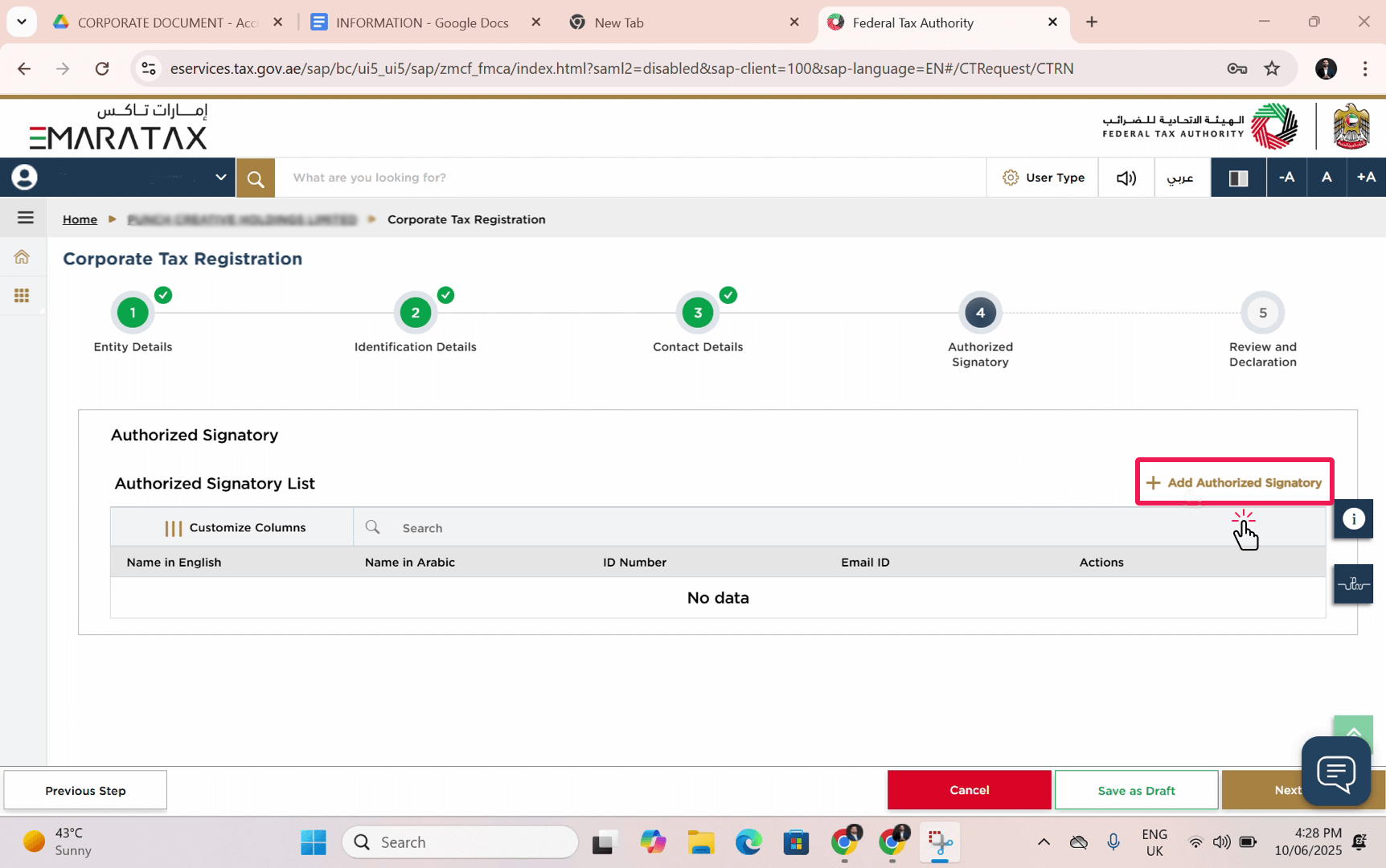

Step 11: Add Authorized Signatory

1. Click Add Authorized Signatory

2. Enter the details of the manager or director who will act as the authorized signatory

3. Select the Source of Authorization — typically the Memorandum of Association

4. Click Add

5. Click Save as Draft and proceed to the next step

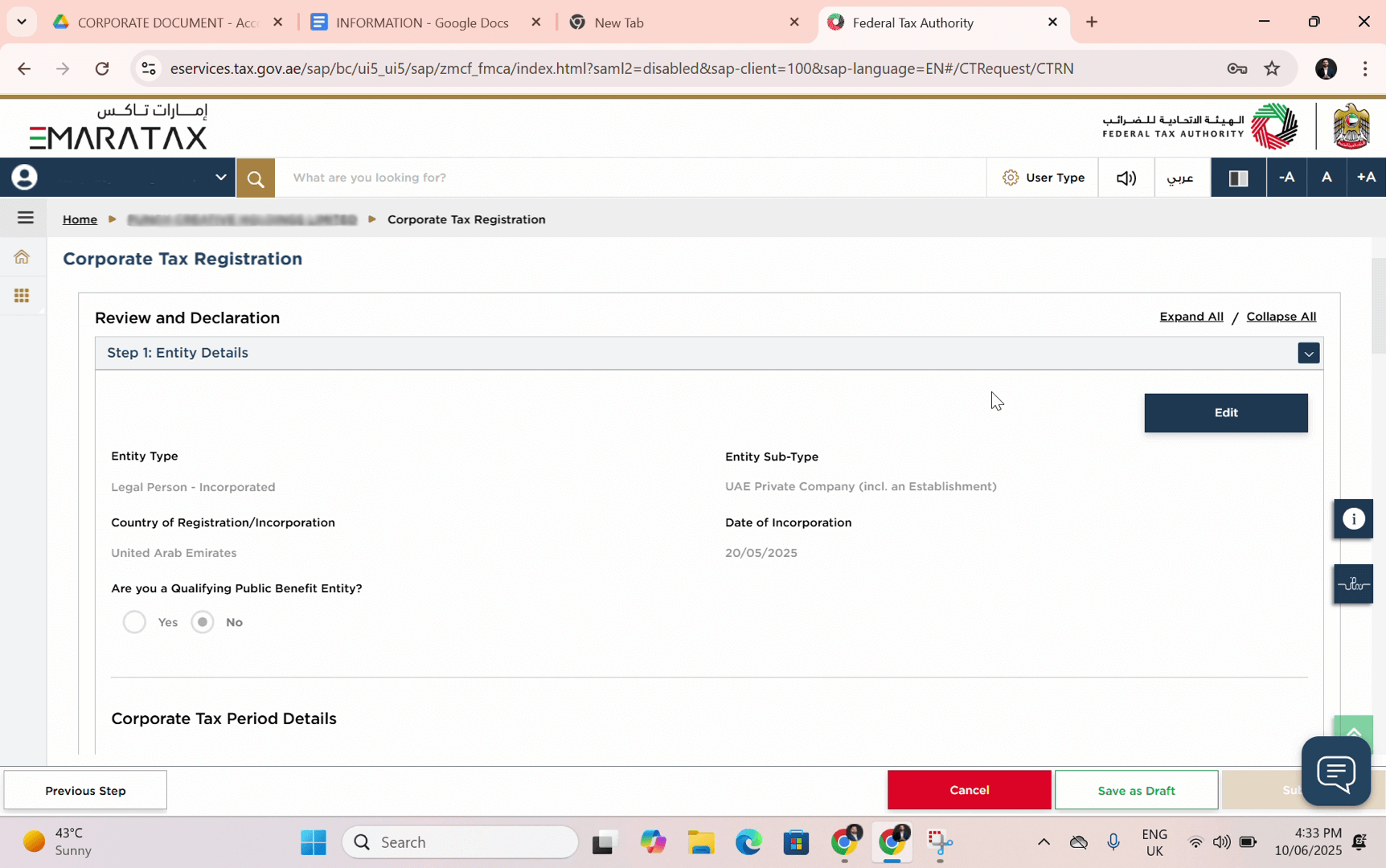

Step 12: Review and Submit

1. Carefully review all the information you’ve entered

2. If everything is correct, check the box to confirm that the information provided is true and accurate

3. Click Submit

Done! Your registration is now complete.

After a taxable person completes corporate tax registration on the FTA portal, the Tax Registration Number (TRN) is typically issued within 20 business days, provided that all required information and documents are complete and accurate.

You will receive an email notification once the TRN is available.

Timeline & fees for corporate tax registration

Registration deadlines

- New companies must register for corporate tax in the UAE within 3 months of receiving their trade license.

- Existing businesses in the UAE were required to complete registration in 2024, based on their license issue date and FTA’s official timeline.

Tax filing deadline

- Corporate tax returns must be filed within 9 months after the end of the financial year.

- Tax payments (if due) are also expected within this 9-month window.

- For most businesses with a standard financial year (January–December), the first return and payment will be due by September 2026. For those registered in 2026, the first return will be due by September 2026.

Registration fees

- FTA registration via the EmaraTax portal is free.

- You can complete the process on your own or contact a business consultant.

- If you choose professional assistance, registration fees will vary depending on the consultant’s pricing and scope of service.

- Corporate Tax (CT) Filing Deadline for UAE Businesses in 2026: What You Need to Know

- UAE Corporate Tax for Offshore Companies (RAK ICC, JAFZA Offshore & Ajman Offshore)

- How the Wage Protection System (WPS) Operates in the UAE

- How to Get UAE Citizenship

- Understanding Leave Entitlements in UAE

- How to check visa status in UAE

- How to start a car rental business in Dubai: complete guide

- How to Start a Gold Business in Dubai: A Complete Guide

- How to Start an Uber Business in Dubai: A Complete Guide

- Probation period in the UAE

Aidina K.

Learn the cost of corporate tax registration

What happens after registration?

After being registered for corporate tax, a company must continue to meet compliance requirements. Businesses in the UAE must meet a number of ongoing obligations to remain in good standing with the Federal Tax Authority. This corporate tax registration guide outlines the key responsibilities:

- Maintain accurate bookkeeping of all income and expenses — particularly important for free zone companies, which must clearly separate qualifying and non-qualifying income.

- Track related-party transactions (transfer pricing) in detail and ensure documentation meets regulatory requirements.

- Review your tax status regularly, ideally on a quarterly basis, to detect and resolve any issues early.

Penalties for non-compliance can be significant.

Failure to register for corporate tax in UAE on time or comply with tax requirements may result in:

- Financial penalties starting at 10,000 AED

- Operational difficulties, including legal complications and restrictions on business activities

To avoid these risks, it is recommended to prepare all necessary documents in advance, monitor updates in tax laws carefully, and seek professional advice when needed.

When and how to deregister

You may apply for corporate tax deregistration if your business no longer meets the mandatory registration criteria — for example, if your annual turnover falls below the threshold.

- How and when: You must apply for deregistration via the EmaraTax portal within 20 working days from when you no longer meet the registration criteria.

- Penalties: Late applications incur fines: 1,000 AED for the first delay and 1,000 AED per month thereafter, up to 10,000 AED.

- Tip: Consulting a tax expert can help you assess your status correctly and meet deadlines.

Common mistakes during corporate tax registration (and how to avoid them)

Common errors during corporate tax registration can lead to fines and delays. The main mistakes include:

- Incomplete or inaccurate applications. These may involve incorrect legal entity type selection, insufficient documentation of expenses and related-party transactions, failure to meet economic substance requirements, and inconsistent accounting policies.

- Wrong entity type selection. This causes tax calculation errors and increases the risk of penalties. It’s essential to clearly understand your business structure and classification before applying.

- Missing deadlines. Registration with the FTA must be completed strictly within prescribed deadlines based on the business license issuance date. Missing deadlines results in fines starting at AED 10,000 and operational risks.

Other frequent mistakes include:

- Ignoring legislative changes

- Underestimating the importance of document retention for 7 years

- Overlooking documentation requirements for transfer pricing and related-party transactions

To avoid these pitfalls, it’s advisable to work with experienced consultants and keep track of deadlines and requirements.

FAQ: UAE corporate tax registration

Yes. Registration is mandatory if your income exceeds AED 375,000, even if your business is not currently profitable. This is required to comply with FTA regulations and prepare necessary filings.

Absolutely. Many businesses and entrepreneurs hire professional consultants to avoid mistakes and speed up the registration process. Consultants help ensure proper document preparation and deadline compliance.

Missing the registration deadline can lead to fines starting at AED 10,000 and operational challenges. It is crucial to apply as soon as possible and seek advice from tax experts to minimize consequences.

Final thoughts: Don’t delay corporate tax registration in the UAE

Corporate tax in the UAE is now a reality for businesses of all sizes — from mainland and free zone companies to freelancers and offshore structures. Registration is mandatory, even if your income is below the taxation threshold. Failure to register or comply with corporate tax obligations can lead to substantial penalties and business disruptions.

If you want to ensure your company meets all legal requirements and avoids costly mistakes, it’s best to work with professionals who understand the local tax environment.

Emirabiz provides full support with business setup in Dubai and all aspects of UAE corporate tax compliance, including:

- Assistance in corporate tax registration through the EmaraTax portal

- Filing annual tax returns

- Obtaining your corporate Tax Registration Number (TRN)

- Tax deregistration when needed

- Ongoing accounting and bookkeeping

- Tax consulting and optimization

- Legal consulting related to corporate tax matters

In addition to tax services, Emirabiz is your trusted partner for:

- Business setup in Dubai and other UAE jurisdictions

- Assistance with UAE residency, including Golden Visas, family visas, and investor visas

- Bank account opening for companies and individuals

- Business licensing in mainland and free zone authorities

Don’t wait until the deadline is near — ensure your company is fully compliant today.

Elena O.

Got a question? Our expert is ready to help!

We will contact you within 1 business day to analyze your case, provide solutions, and calculate costs.

Smooth and speedy process from the initial contact to the final visa approval. Wale was super helpful and professional and always answered promptly all my questions.

Emirabiz is a red carpet service worth paying for and I want to thank Helen and her team for her dedicated support and her amazing follow-through. To launch a business in UAE and get…

Hi, I am Eric, from France. I am very satisfied by the work performed for me by Emirabiz. I was based in Saudi Arabia last year and I wanted to create my Company in UAE. I did everything…

Local Consultancy is quite simply excellent at what they do and the services that they provide. Business owner Elena is completely hands on, looking after my needs as a client personally,…

Strongly recommended! I needed to setup a company in the free zone and I ended up in the right place. Natela and Natalia were super helpful in assisting me in the process from the beginning…

Amazing company to work with. Very fast and efficient. Got all of our Paperwork done and visas + Emirates IDs in a very timely manner. Princess was wonderful and always followed up with me…

It's one of the best services that I received. I keep my relationship with this company for years now. Everything from Visa or Company related matters are resolved here with a very little…

From a scale from 0-10 in which 10 is out if this world amazing, Timi and her team deserve a 11! I decided to move to Dubai with my family and Working with Timi was by far the best decision…

Emirabiz Consultancy has consistently provided reliable and outstanding service for my visa renewal needs. I've been working with them for years, and I am very happy and satisfied with…

I worked with Timi on my golden visa process and she did an amazing job. Everything went smooth and fast! Highly recommend!

Assisted me in obtaining my Golden Visa. A big thank you to Parul Parikh for guiding me through the process and for ensuring that my application was successful. Craig

I had a wonderful experience with Emirabez. Parul Parikh helped in doing my Golden visa. It was completely smooth and hassle free. It was done very quickly. Parul was very cooperative and…

I'd like to thank Mrs. Parul from Emirabiz who has helped me sort out the UAE Residency paper for me. She was incredibly professional, very responsive, knowledgeable about the process, and…

Thank you very much for your service. All was done in a short time and in a very comfortable conditions. The level of Anna Soloviova is high. All her explanations and details of new company…

Your Service was fantastic and flawless! And a very, very special „Thank You“ for Nadia! She provided assistance to solve problems, responded immediately to E-Mails, amazing customer…

I am satisfied with the process, steps and speed of my company incorporation also you helped me a lot and very quickly.Turkey

Hi, I meet Natalia Consultant she help me a lot for my business information with quick response great job Natalia.Pradeep, Sri Lanka

We were considering options for opening a company in one of the free zones in the UAE and sought preliminary advice from Emirabiz. Consultant Natalia provided the most complete information…

I contacted Emirabiz for help in choosing and registering a company in a free zone in the United Arab Emirates. Natalia Maslina, a Business Setup Advisor, provided me with comprehensive…

So First of all thank you so much for your continuous help and quick reply for all my questions and doubts about the formation and setups. Also I am recommending this company for everyone…

I would like to acknowledge an outstanding customer service and comprehensive business development advice provided to me by Natalia. Her high level of professionalism and thoughtful…